Key Points:

- Marine insurers are now charging 0.7% of a ship’s value for voyages to Israeli ports, up sharply from 0.2% previously, due to heightened risks from the Israel-Iran conflict, according to data from insurance broker Marsh McLennan..

- War risk insurance rates have also increased for vessels entering the Red Sea, Marsh reported.

- Coverage related to Israeli ports has seen a significant rise as well, with rates more than tripling to 0.7%.

- The surge in insurance costs highlights the growing instability and security concerns across the Middle East region.

The escalating tension between Israel and Iran has cast a shadow far beyond the battlefield, reaching into the heart of the global shipping industry. As missiles fly and threats loom, shipping companies are grappling with a daunting reality: shipping insurance costs are soaring. In this blog, we uncover the dramatic rise in maritime war risk premiums, explore why this is happening, and highlight what it means for global trade all with insights from real people affected by this crisis.

The Numbers: A Sharp Spike in Costs

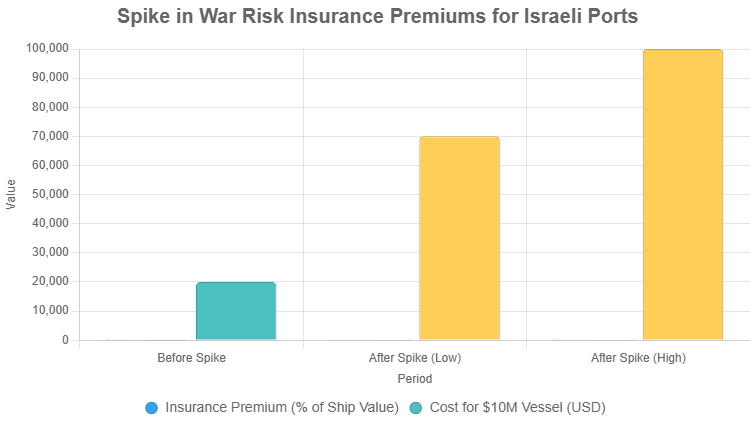

Recent reports paint a stark picture. War risk insurance premiums for shipments to Israel have tripled in just one week. According to industry sources, the cost for a seven-day voyage to Israeli ports has jumped from 0.2% of a ship’s value to between 0.7% and 1.0%. For a $10 million vessel, that’s an increase from $20,000 to as much as $100,000 per trip a hefty price tag for an already tight-margin industry.

The impact isn’t limited to Israel. In the Strait of Hormuz, a critical artery for global oil trade, insurance prices have surged by over 60% since the conflict intensified. Social media is abuzz with this news, with one X user noting, “Insurance prices for ships traveling through the Strait of Hormuz have jumped more than 60% since the start of the war between Israel & Iran.” These numbers signal a seismic shift for shipping routes across the Middle East.

Why Are Insurance Costs Skyrocketing?

The answer lies in risk. The Israel-Iran conflict has turned key shipping lanes into potential danger zones. With Iran-backed Houthi rebels in Yemen threatening attacks on Israel-linked vessels and disruptions rippling through ports and energy infrastructure, insurers are on high alert. Every ship sailing through these waters now carries the weight of uncertainty will it reach its destination unscathed?

This isn’t just about numbers; it’s personal. Imagine being a ship captain rerouting your vessel to avoid missile fire or a small business owner watching shipping fees eat into your profits. The human stakes are real, and they’re driving these costs upward.

Voices from the Industry

Experts are sounding the alarm. David Smith, head of marine at McGill and Partners, explains, “Calls specifically to Israel are very much on a case-by-case basis with rates increased to anywhere up to 1% for a 7-day call, dependent on what cargo, ownership, and port.” His words reveal the painstaking calculations insurers now face.

Jakob Larsen from Bimco, representing global shipowners, adds a sobering perspective: “We’ve seen a modest drop in the number of ships sailing through the affected areas.” Some companies, he implies, are simply saying, “It’s not worth the risk.” These voices remind us that behind the statistics are people making tough calls every day.

The Ripple Effect on Global Trade

The surge in shipping insurance costs doesn’t stop at the shipping companies’ bottom line it’s a domino effect. Higher premiums mean higher freight rates, which could soon translate to pricier goods on store shelves worldwide. From oil to electronics, the global trade impact is looming large.

Worse still, an escalation like Iran closing the Strait of Hormuz could be catastrophic. Oil prices would spike, and supply chains could grind to a halt. One X post put it bluntly: “War risk shipping insurance rates for voyages to Israel three times higher than a week ago after Iranian attacks.” The public is noticing, and they’re worried.

What’s Next for Shipping?

The future hinges on the Israel-Iran conflict. If peace talks emerge, premiums might ease. But if tensions flare, expect costs to climb higher. Shipping firms are already adapting rerouting ships or bolstering security but these fixes come with their own price tags and logistical headaches.

Conclusion: A Sea of Uncertainty

The spike in maritime war risk premiums is more than a financial headache; it’s a human story of resilience amid chaos. As the Israel-Iran conflict unfolds, the shipping industry and all of us who rely on it must brace for choppy waters ahead. Stay tuned as we continue to track this evolving crisis.

1 thought on “Surge in Shipping Insurance Costs Amid Israel-Iran Conflict: What You Need to Know”

Comments are closed.